Small profit and main rates of CT make a come-back, along with marginal rate relief

The chancellor announced the return of the small profit rate and main rate of corporation tax from April 2023. The applicable corporation tax rates will be 19% and 25%. Businesses with profits of £50,000 or below would still only have to pay 19% under small profit rate.

The full rate of 25% is only applicable for the businesses making profits of over £250,000. Businesses earning profits between £50,000 to £250,000 will be able to claim marginal relief which was long forgotten about a decade ago. Mostly it is calculated by the software; however, there will be an updated calculator on gov.uk to work out the marginal relief manually.

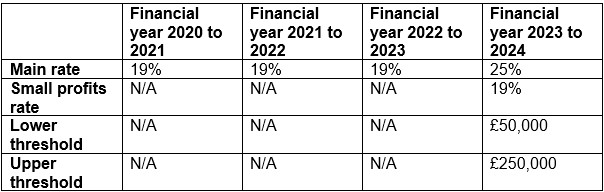

The proposed corporation tax rates will be:

Group companies – watch out

The lower and upper limits will be proportionately reduced for short accounting periods and where there are associated companies. A company is associated with another company at a particular time if, at that time or at any other time within the preceding 12 months:

- one company has control of the other

- both companies are under the control of the same person or group of persons.

The related 51% group company test at s279F to s269H CTA 2010 will be repealed and replaced by associated company rules.

The thresholds that apply for determining whether a company is chargeable at the small ring fence profits rate at s279E Corporation Tax Act 2010 will be aligned with these limits.

Despite the increase announced, UK will still have the lowest corporation tax in the G7 countries. It is expected that 1.4m businesses will be unaffected by this change.

This article has been shared from ACCA In Practice, to whom copyright belongs. Whitefield Tax are an ACCA Member Firm