An extended version of the CJRS provides further support for employees until the end of September

In December, the CJRS scheme was extended to the end of April 2021 in anticipation of lockdown measures ending by around March. Due to the gradual lockdown lifting measures announced recently, chancellor Rishi Sunak has now announced a further extension of the Coronavirus Job Retention Scheme. This means that furlough grants will continue until the end of September 2021, instead of ending on 30 April 2021.

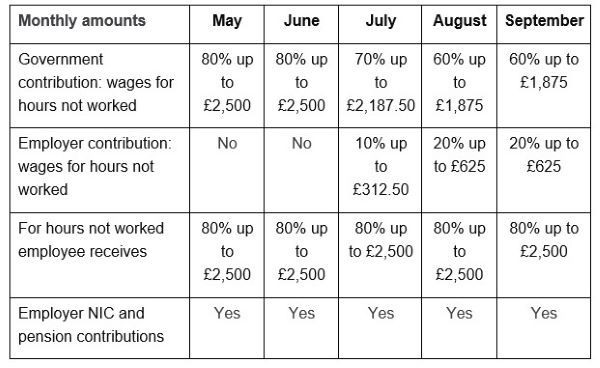

In the latest round of extensions to the scheme, support will be gradually withdrawn with employers expected to contribute more to the wages with reduced furlough grants from the government. Furlough grants will continue at the rate of 80% of employees’ wages capped at £2,500 per month until the end of June 2021. Thereafter, employers will be expected to contribute 10% in July 2021 and 20% in August 2021 and September 2021 with the furlough grants reducing proportionately.

As summarised in the table below, employees will continue to receive 80% of their salary for hours not worked until the scheme ends with employers contributing more for the last three months. As before, employers can continue to choose to top up their employees’ wages above the 80% total and £2,500 cap for the hours not worked at their own expense.

This article has been shared from ACCA In Practice, to whom copyright belongs. Whitefield Tax are an ACCA Member Firm