Temporary VAT rate reduction extended until September

To support the most vulnerable businesses hit by the pandemic, chancellor Rishi Sunak announced the extension of the reduced rate of VAT of 5% to the hospitality sector, holiday accommodation and attractions until 30 September 2021. After this date, the VAT rate will be 12.5% to 31 March 2022, before reverting to the standard rate of VAT of 20%.

Applicable VAT for these businesses will be:

- Standard rate of VAT before 14 July 2020 – 20%

- 15 July 2020 to 30 September 2021 – 5%

- 1 October 2021 to 31 March 2022 – 12.5%

- 1 April 2022 onwards – 20%

More VAT guidance on these industries can be found here.

Additionally, last year some other VAT changes were announced to reduce the impact of the pandemic, the summary of which can be accessed here.

VAT deferral new payment scheme

As announced within the winter plan, any business that took advantage of the original VAT deferral on VAT returns from 20 March through to the end of June 2020 can now opt to use the VAT Deferral New Payment Scheme to pay that deferred VAT in up to 11 equal payments from March 2021, rather than one larger payment due by 31 March 2021, as originally announced. All businesses which took advantage of the VAT deferral can use the New Payment Scheme. Businesses will need to opt in, but all are eligible.

To take the advantage of VAT deferral, businesses will need to join the new payment scheme. The online service is open between 23 February 2021 and 21 June 2021. The new scheme allows the payment of deferred VAT in equal instalments, interest free.

Businesses can join the scheme by clicking on this link. Before joining, you must:

- create your own Government Gateway account (if you do not already have one)

- submit any outstanding VAT returns from the last four years – otherwise you’ll not be able to join the scheme

- correct errors on your VAT returns as soon as possible

- make sure you know how much you owe, including the amount you originally deferred and how much you may have already paid.

No change in VAT thresholds

The VAT registration and deregistration thresholds will not change for a further period of two years from 1 April 2022 up to and including 2023-24, giving businesses certainty. Current VAT registration and deregistration thresholds are £85,000 and £83,000 respectively.

New point-based regime for penalties for VAT and income tax

In order to facilitate greater harmonisation, the government will reform the penalty regime for VAT and Income Tax Self Assessment (ITSA) to make it fairer and more consistent.

The new late submission regime will be points-based, and a financial penalty will only be issued when the relevant threshold is reached.

The new late payment regime will introduce penalties proportionate to the amount of tax owed and how late the tax due is. The government will introduce a new approach to interest charges and repayment interest to align VAT with other tax regimes.

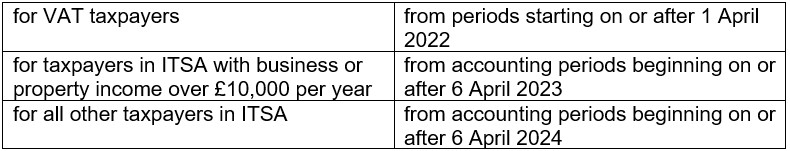

These reforms will come into effect:

Full details of the current penalty regime can be found from CH10000 onwards.

This article has been shared from ACCA In Practice, to whom copyright belongs. Whitefield Tax are an ACCA Member Firm